A Record-Breaker, Not Just Another Headline

In mid-2025, London’s Metropolitan Police revealed that they had seized approximately 61,000 BTC, tied to a massive fraud scheme originating in China. The defendant, Zhimin Qian (aka “Yadi Zhang”), pleaded guilty to charges involving the acquisition and possession of criminal property.

By value, that haul is being marketed as the single largest cryptocurrency seizure in the world (>$6–7 billion, depending on BTC’s price). But the real story isn’t the dollar signs—it’s what this case reveals about the maturing capabilities of crypto tracing, compliance, and multi-jurisdictional cooperation.

Seizures Up ≠ Crime Up (But Detection Is Sharper)

It’s easy to misread headlines: “biggest ever” might imply crime is out of control. But as insiders (including our team at BitAML) view it, the more compelling takeaway is that law enforcement and compliance tooling are catching up.

As BitAML Founder Joe Ciccolo put it:

“That just means that law enforcement is getting better at what they’re doing … they’re honing their craft … these numbers are going to get even more impressive in the years ahead.”

In short, the blockchain doesn’t change—but our ability to mine insights from it does.

Myth vs. Reality — Crypto Is Not Invisible

One of the most persistent misunderstandings is that cryptocurrencies are inherently anonymous. That’s not true—Bitcoin is pseudonymous, but traceable. And in high-stakes cases, it routinely crumbles under scrutiny.

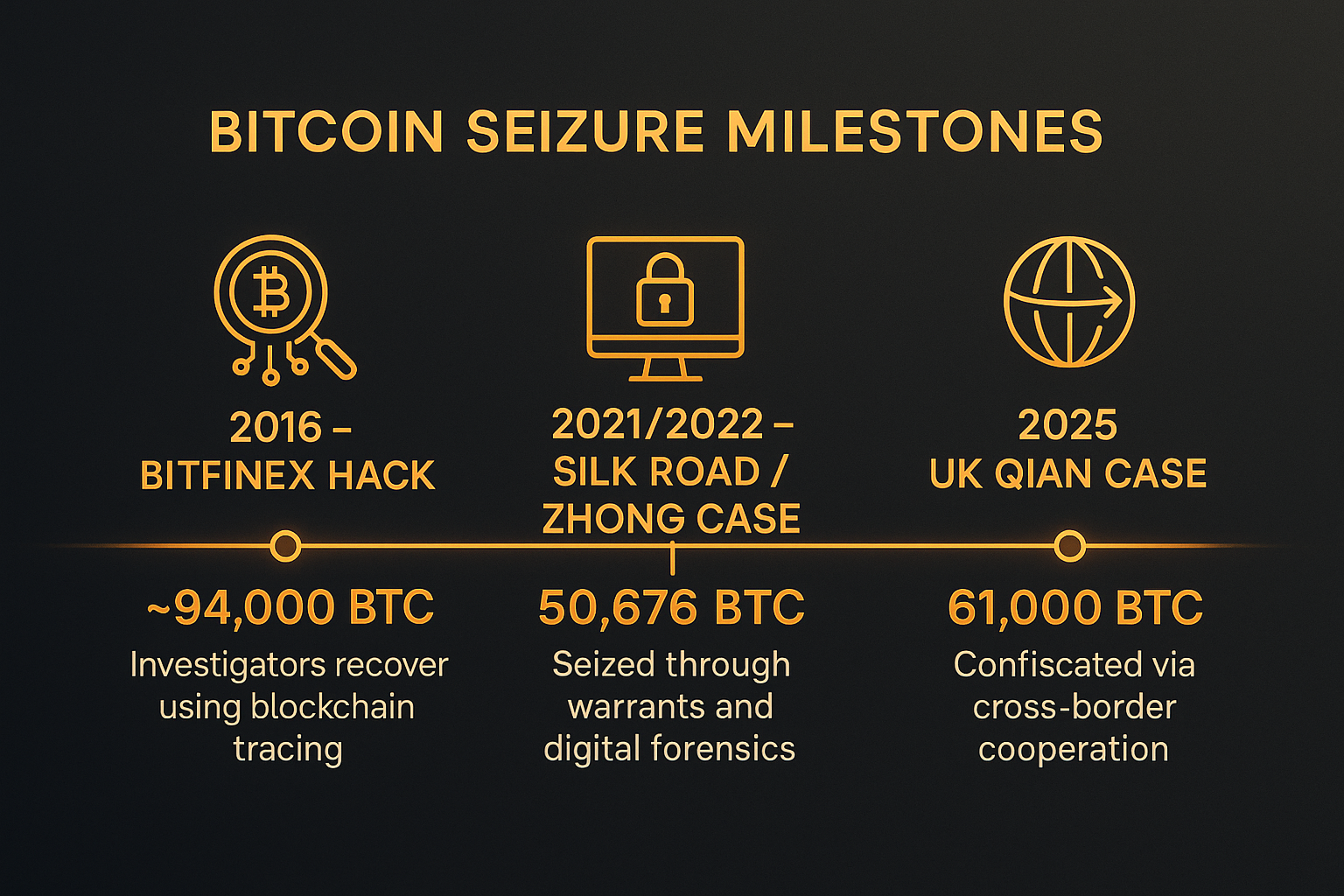

Let’s look at two key precedents:

- Silk Road / James Zhong (2021 seizure → 2022 conviction): In November 2021, law enforcement raided Zhong’s home in Georgia and seized 50,676 BTC, then valued at ~$3.36 billion, after tracing transactions and executing search warrants.

- Bitfinex hack / U.S. recovery: The 2016 attack on Bitfinex resulted in the theft of ~119,756 BTC. Over time, investigators used blockchain analysis, intelligence, subpoenas, and cooperation to reclaim large portions—by 2022, ~94,643 BTC (~$3.6 billion) had been seized.

These cases share a clear formula: on-chain transparency + traditional law enforcement tools = successful attribution and seizure.

The UK seizure of 61,000 BTC is the next logical step—not an outlier but part of a pattern. It shows that tracing is transitioning from being an exceptional capability to an expected baseline in serious investigations.

Capability in Action: The Seizure Timeline

Here’s how these high-dollar recoveries have evolved:

Because each successful case adds to the institutional memory of tracing, today’s law enforcement teams are sharper, faster, and more confident in tackling large crypto seizures.

The Baton Pass: Compliance + Law Enforcement, A Symbiotic Loop

Seizures like this one underscore a vital feedback mechanism: strong compliance programs make law enforcement’s job easier, and effective law enforcement raises the expectations on compliance functions.

Here’s how the loop works (BitAML POV):

- Exchanges and service providers model risk via KYC/EDD, sanction filtering, and transactional monitoring.

- Alerts are flagged, escalated, and logged with quality narratives (including TXIDs, counterparties, typologies).

- Suspicious Activity Reports (SARs) become actionable leads for law enforcement.

- Investigators marry those leads with on-chain tracing, intelligence, and cross-border cooperation.

- Seizure or disruption feeds back into typology refinement, public outcomes, and institutional expectations.

What examiners and investigators look for (bullet form):

- Typology-driven alerts (e.g., peeling, chain hopping, mixers, high-risk exchanges)

- Negative news / sanction linkage controls

- Robust escalation documentation

- Documented law enforcement intake/liaison procedures

There’s also Operation Shamrock, a coalition of law enforcement agencies, compliance professionals, digital sleuths, and victim advocates (2,500+ members) that exchanges investigations, best practices, and victim funnels. This kind of network amplifies tracing power, especially across borders.

With each high-profile seizure, compliance teams get a clearer signal: law enforcement is more able, more technical, more determined.

Why This Matters to Compliance Teams Right Now

If compliance were optional, we’d see fewer headlines like this. But as the seizure landscape intensifies, AML teams are increasingly under pressure to prove they’re not just catching up—they’re staying ahead.

Here’s a quick checklist to strengthen your posture:

- Reassess customer risk tiers; flag high-risk geographies, mixers, OTC exposure, nested flows.

- Tune TM (transaction monitoring) rules to pick up bridging, peeling, mixing, anomalous behavior.

- Improve SAR quality: narratives should be clear, and include TXIDs, entity links, and exposure maps.

- Create a documented LE playbook: intake, hold protocols, evidence packaging.

- Prioritize tracing training for AML teams, tabletop exercises with mock subpoenas.

- Vet chain analytics vendors: check their model governance, accuracy assertions, logs.

Because to law enforcement, poor narratives aren’t just a drag—they’re a possible dead end.

Looking Ahead: What’s Next in Trace & Seize

The 61,000 BTC seizure is a milestone, not a finish line. Here are signals to watch:

- Increased seizure volume and value: once rare, these cases may become headline regulars.

- Cross-chain complexity: tracing across rollups, L2s, bridges will push tools and legal reach.

- Public outcomes: who gets the recovered funds? Courts may weigh victim compensation vs. state retention.

- Enhanced regulation of tracing expectations: regulators may demand proof of on-chain readiness.

In effect, tracing is becoming a minimum expectation, not a differentiator.

A Final Thought

In the saga of the “biggest Bitcoin seizure ever,” the star of the show isn’t the money. It’s the technique: a blend of archival ledgers, modern forensics, old-school detective work, and transnational coordination.

Blockchains don’t forget—and good AML programs don’t either.

Want BitAML to review your tracing readiness? We’ll audit your typologies, alerts, SAR narratives, and escalation protocols—and deliver a prioritized punch list to help you pass examiner stress tests. Book a discovery call with BitAML to get started.