What are the consequences when prediction becomes a product?

When a Prediction Turns Into a Payout

Just days before U.S. forces captured Venezuelan President Nicolás Maduro in January 2026, someone quietly placed a large wager on an online prediction market that he would be out of power by the end of the month. When the capture happened, that bet—placed for roughly $30,000—resolved in favor of the trader, paying out more than $400,000 almost instantly.

It (most likely) wasn’t just a lucky guess. The trade raised uncomfortable questions about who knew what, and when—and about how platforms like Polymarket and Kalshi allow people to turn real-world events into real money, in near real time.

That moment captures the core idea behind prediction markets. When forecasts have real money attached, people don’t just talk. They pay attention. Markets begin surfacing signals in places where traditional narratives often lag or miss entirely.

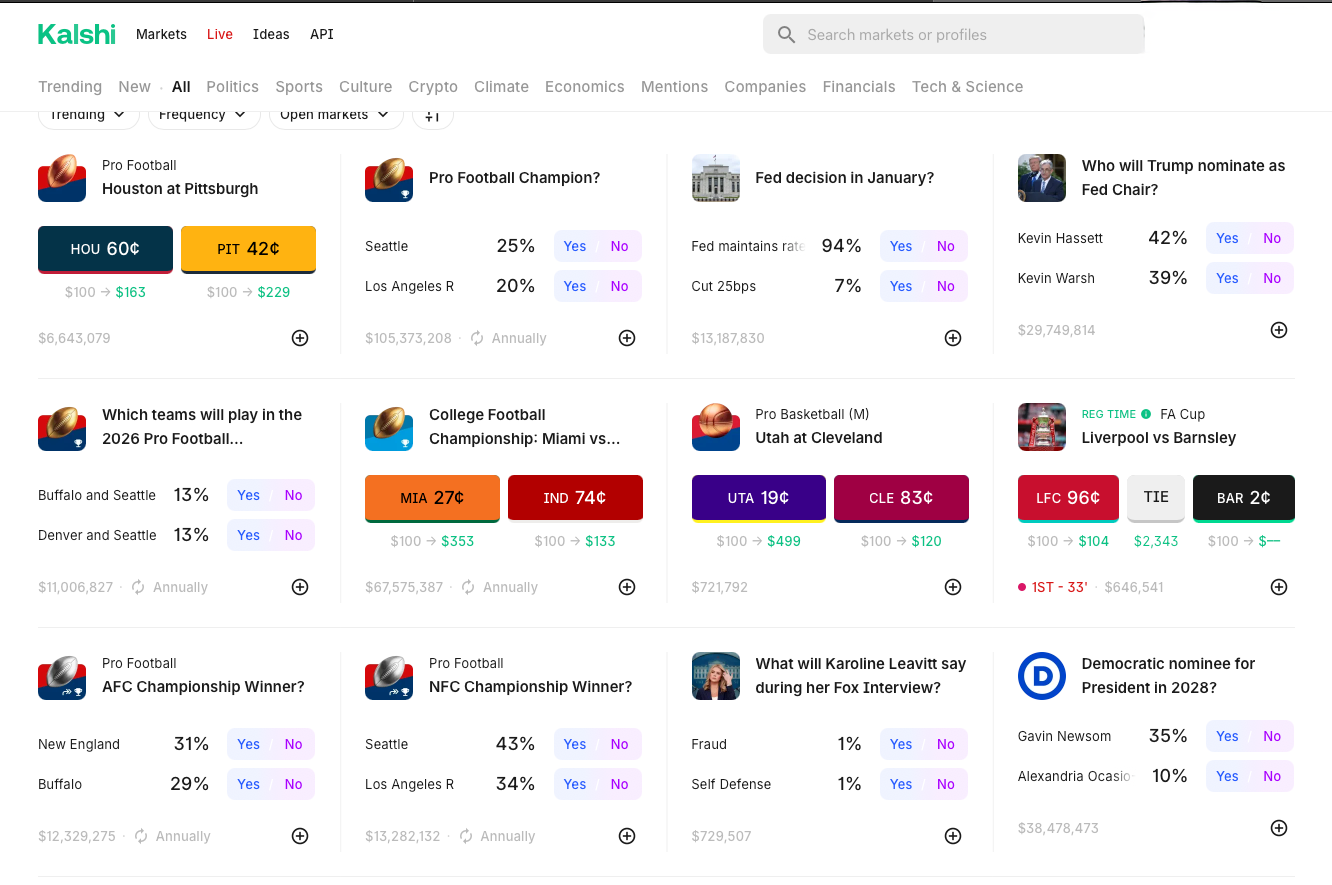

And importantly, these bets aren’t limited to casino-style games or major sporting events. In prediction markets, almost anything can become tradable—elections, policy decisions, corporate actions, geopolitical events, even popculture—wherever uncertainty exists and outcomes can be defined.

January Forecasts, but With Money on the Line

Every January, predictions are everywhere. Timelines fill up with confident takes about elections, markets, tech launches, and what the year ahead will bring. Some of it is thoughtful. Much of it is noise. Almost none of it carries consequences.

But there’s a growing corner of the internet—and increasingly, the mainstream—where predictions aren’t just posted. They’re priced.

Some people don’t just predict outcomes. They trade them.

That’s the shift worth paying attention to. When money replaces applause, spin fades fast—and signal tends to rise to the surface.

What Is a Prediction Market?

At its simplest, a prediction market lets participants trade contracts tied to specific outcomes. Most are structured as yes/no questions: Will X happen by Y date?

Each contract is priced between $0.00 and $1.00. The price reflects the market’s collective assessment of probability. A contract trading at $0.70 implies a 70% chance the event will occur. If it resolves “yes,” it pays out $1.00. If not, it settles at zero.

Buy at $0.70 and win, you earn $0.30. Buy at $0.70 and lose, you lose your stake.

What makes these markets sticky isn’t just the mechanics—it’s the combination of incentives, information, and opinion in one place. Participants bring research, intuition, public data, and sometimes private insight, all filtered through a single constraint: being right has a price.

And unlike casinos or traditional sports betting apps, you’re not wagering against a sportsbook. You’re trading contracts with other participants, with prices set by supply and demand—not by the house.

Accessibility has never been easier. Many of these markets now live inside clean, intuitive apps, lowering the barrier between “thinking about an outcome” and “putting money behind it.”

Where Prediction Markets Get Tricky—Information, Influence, and Manipulation

One of the reasons prediction markets feel so powerful is the same reason they deserve closer scrutiny: they turn information into money.

In traditional financial markets, decades of case law and enforcement history define concepts like insider trading and market manipulation. Prediction markets, by contrast, are still writing those rules in real time—and that creates gray areas that are easy to exploit.

At a high level, the risk isn’t that prediction markets exist. It’s what people are allowed to bet on, and who has influence over the outcome.

Not all prediction markets carry the same risk. Broad, macro-level events—national elections, major economic indicators, even weather outcomes—are generally difficult to manipulate. These markets tend to be information-dense, widely observed, and resilient. No individual actor controls the outcome, and no single trader can easily move the price.

The risk profile changes quickly as markets move from macro events to micro ones.

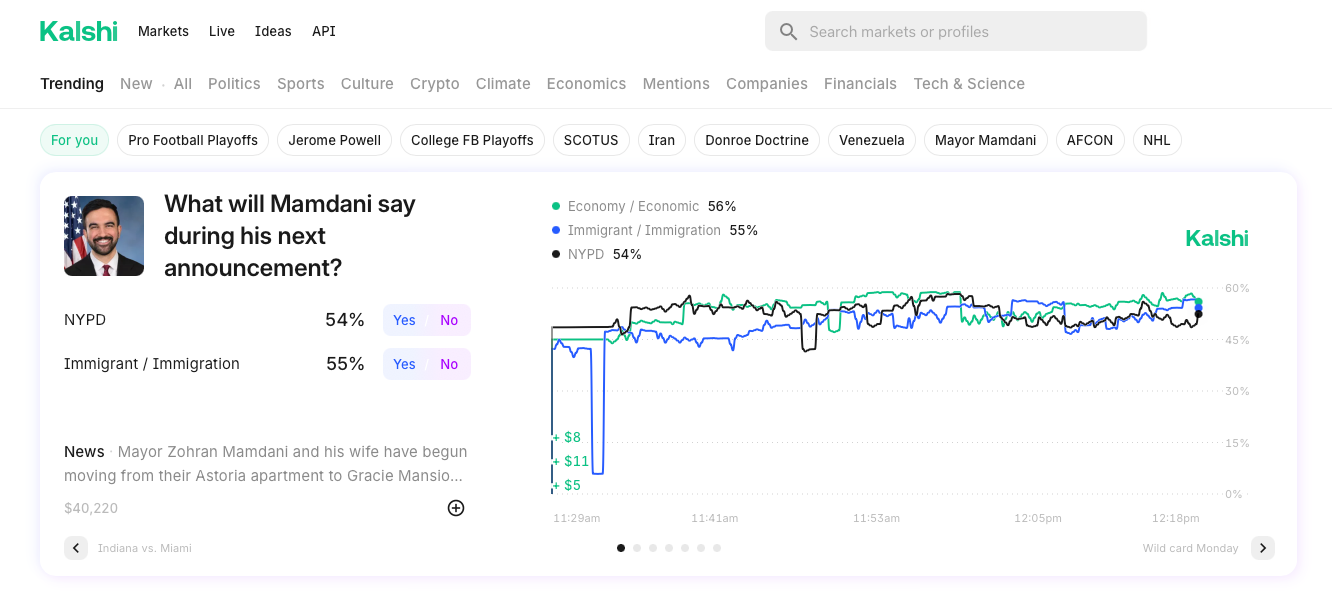

Micro events are narrow, specific, and often lightly monitored:

– The wording of a regulator’s speech

– Whether a product launch is delayed

– How a policy decision is framed

– What gets announced at a press conference

In these cases, manipulation doesn’t require fraud in the traditional sense. It can simply require proximity.

A speechwriter, staffer, advisor, contractor, or employee may not control the final outcome—but they may have early knowledge, influence, or context that allows them to tilt the odds. And because many of these markets are new, fragmented, and inconsistently regulated, the incentives to rationalize that behavior are strong. The speech still happens. The decision still gets made. No one feels harmed.

This is where prediction markets start to resemble familiar financial-crime patterns in new clothing.

Market structure matters here too. In thinner markets with low trading volume, a single large trader—or a coordinated group—can move prices quickly without obvious wrongdoing. Market makers can improve liquidity and usability, but they don’t eliminate the underlying reality: some contracts are inherently easier to “push” than others.

The issue isn’t whether someone directly rigged an outcome. It’s whether they traded on non-public information or used their position to subtly shape results in their favor. That invisible advantage undermines the integrity of the signal prediction markets claim to produce.

And unlike traditional securities markets, many of these behaviors aren’t clearly or explicitly illegal yet. Oversight is uneven. Enforcement expectations are still forming. That gap between capability and accountability is exactly where regulators tend to focus next.

Prediction markets may surface real signal—but without guardrails, they can just as easily reward access, influence, and proximity instead of insight. That’s the tension regulators are starting to pay attention to.

The Big Players—and Why This Suddenly Feels Mainstream

Prediction markets aren’t new, but the ecosystem around them has matured quickly.

Kalshi represents the regulated lane: a CFTC-regulated exchange for event contracts, often cited as the example for how prediction markets can operate inside the U.S. regulatory perimeter.

Polymarket occupies the crypto-native lane. It’s become the cultural reference point for prediction markets going viral—fast-moving, internet-native, and frequently cited when markets appear to “know something” before headlines catch up. It has also been at the center of regulatory scrutiny, prompting ongoing conversations about compliant pathways forward.

Manifold Markets sits somewhere else entirely: a social, play-money environment that functions like a laboratory. Its value isn’t payouts, but speed and scope—a reminder of how quickly everything becomes a market once the tools exist.

Then came the real accelerant.

DraftKings rolled out a standalone predictions product across much of the U.S. FanDuel followed with FanDuel Predicts, launching first in five states with plans to expand in early 2026—both through partnerships tied to regulated event-contract infrastructure.

At first glance, this looks like innovation for innovation’s sake. Established sportsbooks experimenting with new formats to stay relevant. But as we’ll see later, this move is about more than staying on the cutting edge. It reflects a growing awareness that prediction markets can operate in regulatory spaces traditional betting products can’t—a form of regulatory arbitrage that’s quietly reshaping the landscape.

That’s the real shift. Prediction markets aren’t just for forecasting enthusiasts anymore. They’re getting sportsbook-grade distribution, with implications regulators and operators can’t ignore.

Sports Betting vs. Prediction Markets: A Useful Distinction

At a high level, the difference looks like this:

- Sports betting involves wagering against a sportsbook, with odds set by the house and regulated by state gaming authorities.

- Prediction markets involve trading contracts tied to outcomes, with prices set by the market and, in some cases, regulated federally under derivatives frameworks.

One is framed primarily as gambling. The other is framed as information aggregation.

That distinction—whether or not you agree with it—sits at the heart of the regulatory debate.

Mainstream Moments: How Wide These Markets Have Become

Elections were the first mainstream attention driver, but they’re far from the only ones now.

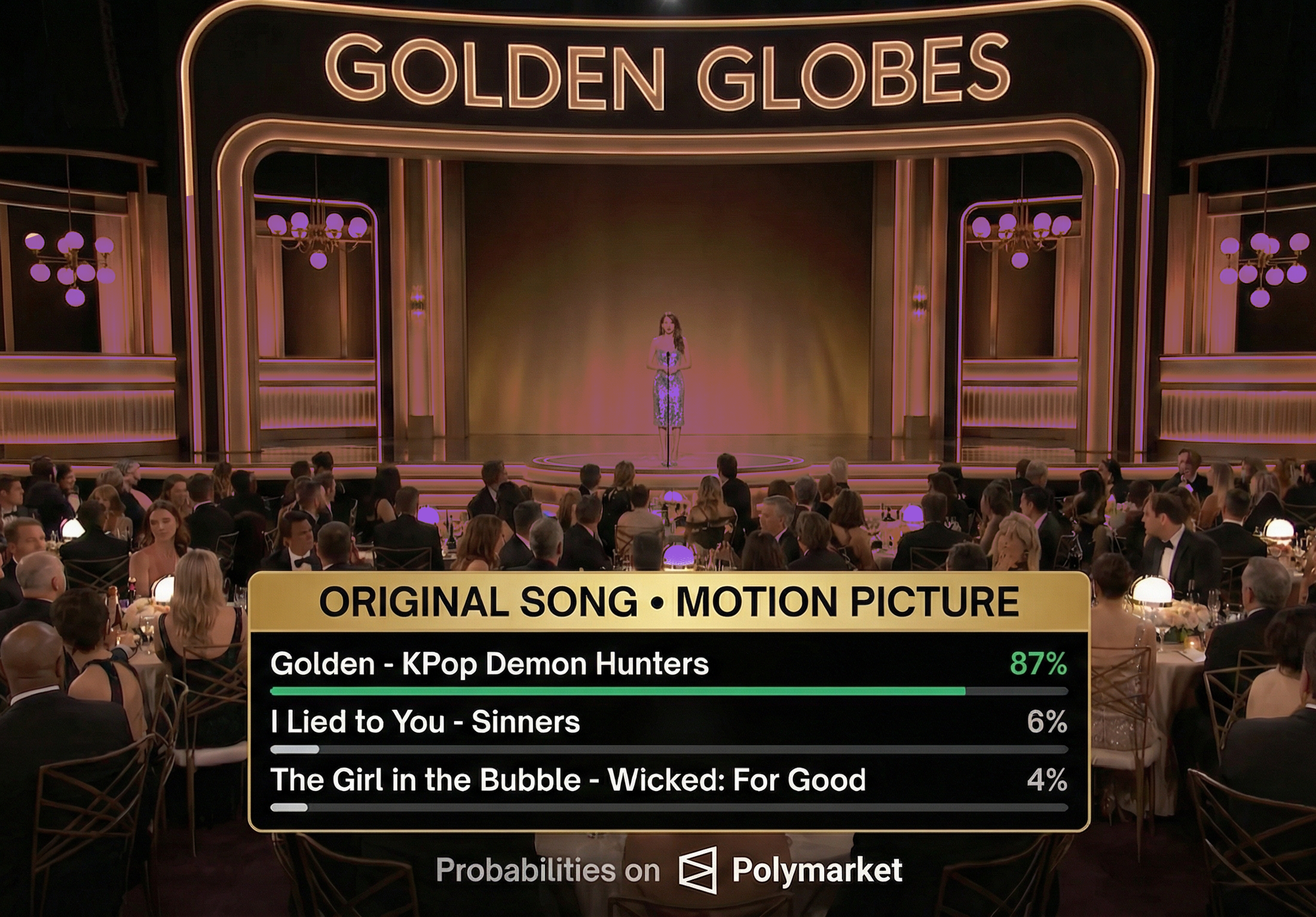

Markets exist around policy outcomes, interest rate decisions, corporate actions, entertainment releases, and cultural moments. You can find contracts on awards shows, product launch timing, and even how many times a public figure might post on social media in a given week.

The 2024 U.S. presidential election. The release timing of a major video game. Monthly rainfall in San Francisco.

Once something can be measured, it can be traded. For proof of this (and a signal of more to come) just take note of last week’s Golden Globe Awards where they were showing odds on the next award category before cutting to a commercial break.

That breadth is what makes prediction markets feel different. They don’t just mirror existing betting categories. They create new ones—often faster than traditional institutions know how to respond. How long before Bravo is listing probabilities of what will happen after the commercial break during The Real Housewives of Salt Lake City? You can be sure of one thing, it won’t just be young men putting their bets down. And that seems to be the growth factor behind these behemoth platforms, they will tap into a phantom market and create a new generation of gamblers that never have to leave their couch.

Why Markets Can Feel More Accurate Than the Narrative

Prediction markets feel compelling because they reward being right, not being loud.

Participants put real money behind beliefs. Prices aggregate public reporting, private research, lived experience, and crowd sentiment into a single, continuously updated signal.

That doesn’t make markets infallible. They’re not truth machines. They’re living consensus mechanisms—useful, dynamic, and sometimes wrong. But increasingly, prediction market odds are cited as signals by people who never place a trade themselves: journalists, analysts, researchers, and decision-makers looking for early indicators when narratives haven’t settled.

The signal travels beyond the market.

Signal vs. Safeguards

Prediction markets are powerful because they turn opinion into signal by putting real incentives behind being right. That’s why they’re spreading so quickly across politics, policy, and culture.

But as these markets move from novelty to mainstream, questions about oversight and consumer protection stop being theoretical. They become operational.

In Part 2, we’ll shift from why prediction markets work to what happens when they scale—who regulates them, where the gaps are, and what businesses operating in or near this space should be thinking about now.

If you’re building, advising, or investing anywhere near prediction markets—and want to understand the compliance questions before they become problems—this is the moment to get ahead of them. Book a discovery call with BitAML

Join us for Part 2 of our blog series on prediction markets as we unpack the safeguards this signal demands.